Major amendments proposed in the new income tax regime 2024-25: Changes made in the new income tax regime: Tax slabs have been revised under the new tax structure. The proposed tax structure is given at the end of the following paragraph. Under the new tax regime, the standard deduction for salaried individuals and pensioners is proposed to be increased from ₹50,000 to ₹75,000. The deduction from family pension is also proposed to be increased from ₹15,000 to ₹25,000. Pension contributions will be exempt from tax up to 14% of salary for employer and employee (earlier it was 10%).

.

.

.

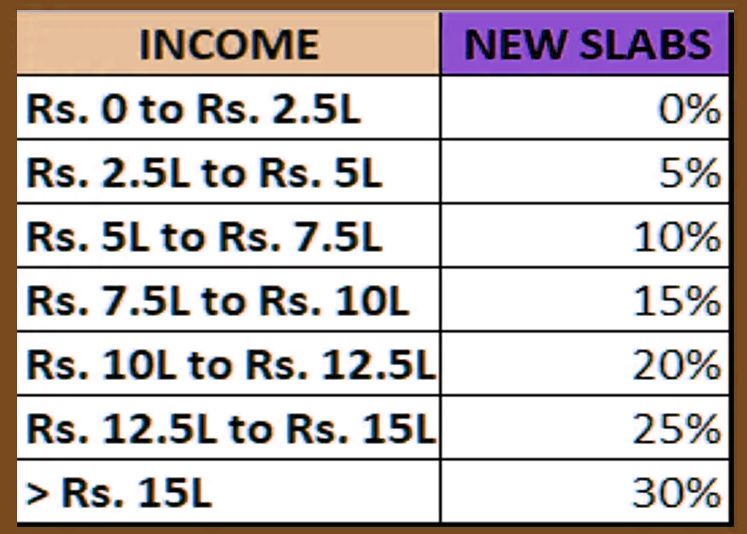

New Income Tax Slab Structure:

The following changes have been proposed in the tax slabs under the new income tax regime:

1. Zero Tax Rate (Nil):

– Current Income Slab: Up to ₹3 lakh

– Proposed Income Slab: Up to ₹3 lakh

2. 5% Tax Rate:

– Current Income Slab: ₹3 lakh to ₹6 lakh

– Proposed Income Slab: ₹3 lakh to ₹7 lakh

3. 10% Tax Rate:

– Current Income Slab: ₹6 lakh to ₹9 lakh

– Proposed Income Slab: ₹7 lakh to ₹10 lakh

4. 15% Tax Rate:

– Current Income Slab: ₹9 lakh to ₹12 lakh

– Proposed Income Slab: ₹10 lakh to ₹12 lakh

5. 20% Tax Rate:

– Current Income Slab: ₹12 lakh to ₹15 lakh

– Proposed Income Slabs: ₹12 lakh to ₹15 lakh

6. 30% tax rate:

– Current income slab: Above ₹15 lakh

– Proposed income slab: Above ₹15 lakh

Proposed changes in investment and taxation:

1. Long and short-term capital gains tax:

– Short-term capital gains tax: This tax will be increased from 15% to 20% on listed stocks, equity mutual funds, and REITs/INVITs.

– Long-term capital gains tax: This tax will be 12.5% on all asset categories. Earlier this tax was 10% on listed stocks, equity mutual fund units, and REITs/INVITs and 20% (with indexation) on other assets.

– Indexation abolished: Indexation will be abolished in the calculation of long-term capital gains for property, gold, and other unlisted assets.

– Definition of long-term: Listed financial assets will be classified as long-term after one year, while unlisted financial assets and all non-financial assets will be required to be held for at least two years to be classified as long-term.

– Exemption limit: The exemption limit for long-term capital gains arising from listed shares, equity mutual funds, and business trusts will be increased from ₹1 lakh to ₹1.25 lakh.

– Share buyback: Share buyback will be treated at par with dividend.

2. Securities Transaction Tax (STT):

– Sale of options: STT on sale of options in the securities market will be increased from 0.0625% to 0.1%.

– Sale of futures: STT on sale of futures will be increased from 0.0125% to 0.02%.

3. Tax Deducted at Source (TDS):

– TDS rates: The rate of TDS on several items such as insurance commission, life insurance policies, rental payments, and commission or brokerage is proposed to be reduced from 5% to 2%.

– E-commerce payments: TDS on proceeds of sales by e-commerce operators to e-commerce participants will be reduced from 1% to 0.1%.

4. Direct Tax Vivaad se Vishwas Scheme, 2024:

– This scheme will be introduced for settlement of tax disputes, providing flexibility in payment of disputed interest or penalty.

5. Equalization Levy:

– Equalization levy of 2% on the amount received on supply of goods or services by a non-resident e-commerce operator will not be applicable from August 1, 2024.

6. Changes in Custom Duty:

– Duty reduction: Custom duty on gold and silver, and mobile phones and their chargers/adapters has been reduced.

– Exemptions: Certain items used in the textiles, steel, and capital goods sectors have been exempted from custom duty.

– Duty hike: Custom duty has been increased on solar glass (used in the manufacture of solar cells or modules) and certain chemicals.

Major amendments proposed in the new income tax regime 2024-25.

Need to reed more details in this tax regime 2024-25 PRS India.

DoFollow Our Instagram, X (twitter)

Click for more updates and latest Entertainment, Llifestyle, Sports Gadgets. Also get latest news at Classic Square Newsline.